Eliza Owen 1 Mar 2021

The temporary supplement to JobSeeker payments in Australia are set to finish at the end of March 2021. The JobSeeker ‘coronavirus supplement’ was a temporary boost to new and existing recipients of welfare schemes in response to the onset of COVID-19 including JobSeeker, Youth Allowance, Austudy and the Parenting Payment.

In early 2020, the supplement was set at an additional $275 per week, virtually doubling payments for some recipients. Recently, it was announced that as the coronavirus supplement is wound down from March, a permanent $25 increase will be added to payments. While a permanent increase will make some better off, welfare recipients will be worse off by $250 per week compared with the onset of COVID-19.

But will the removal of the JobSeeker supplement have any impact on the housing market?

First and foremost, it is important to acknowledge that the JobSeeker supplement has already been reduced significantly in recent months, with no dampening impact apparent on the housing market as a whole.

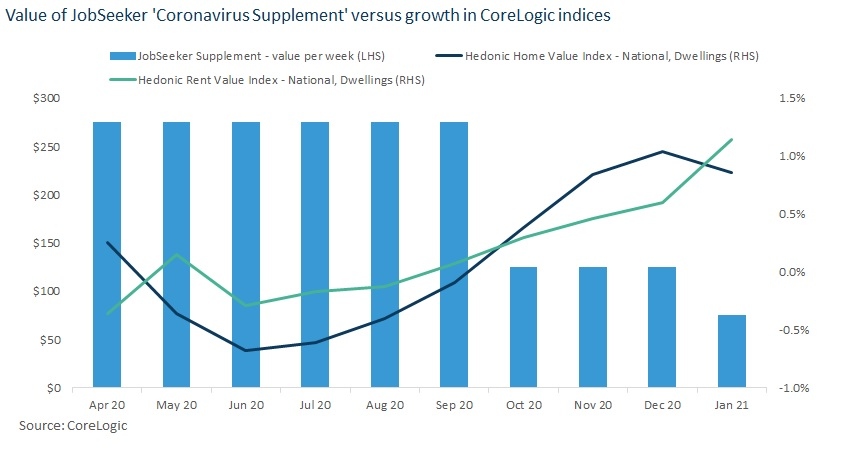

In late March 2020, the original Jobseeker supplement was set at an additional $275 per week. In late September, the supplement was reduced to $125 per week, and it was reduced further to $75 per week through the first quarter of 2021.

However, housing market momentum has increased from September to January, amid the reduction in the supplement. Between the end of September and January, the CoreLogic national home value index rose 3.2%, and rental values increased 2.5%.

Another consideration is that even as the Jobseeker coronavirus supplement reduced, fewer Australians have been reliant on welfare due to a strong recovery trend in the labour market.

Data from the Australian Government Department of Social Services (DSS) suggests there were 11.7% fewer JobSeeker recipients toward the end January 2020, compared with the end of September. However, there is still a heightened risk to wider-spread housing stress, as the number of JobSeeker recipients at January was still 55.9% higher than at the onset of COVID-19 in March 2020.

Changes to JobSeeker would likely have little direct impact on housing market values. With lower income households generally having lower rates of home ownership, it is more likely that households receiving JobSeeker are renters. This would imply an indirect impact on housing prices, where reduced rental return could impact an investor’s willingness to pay for a property.

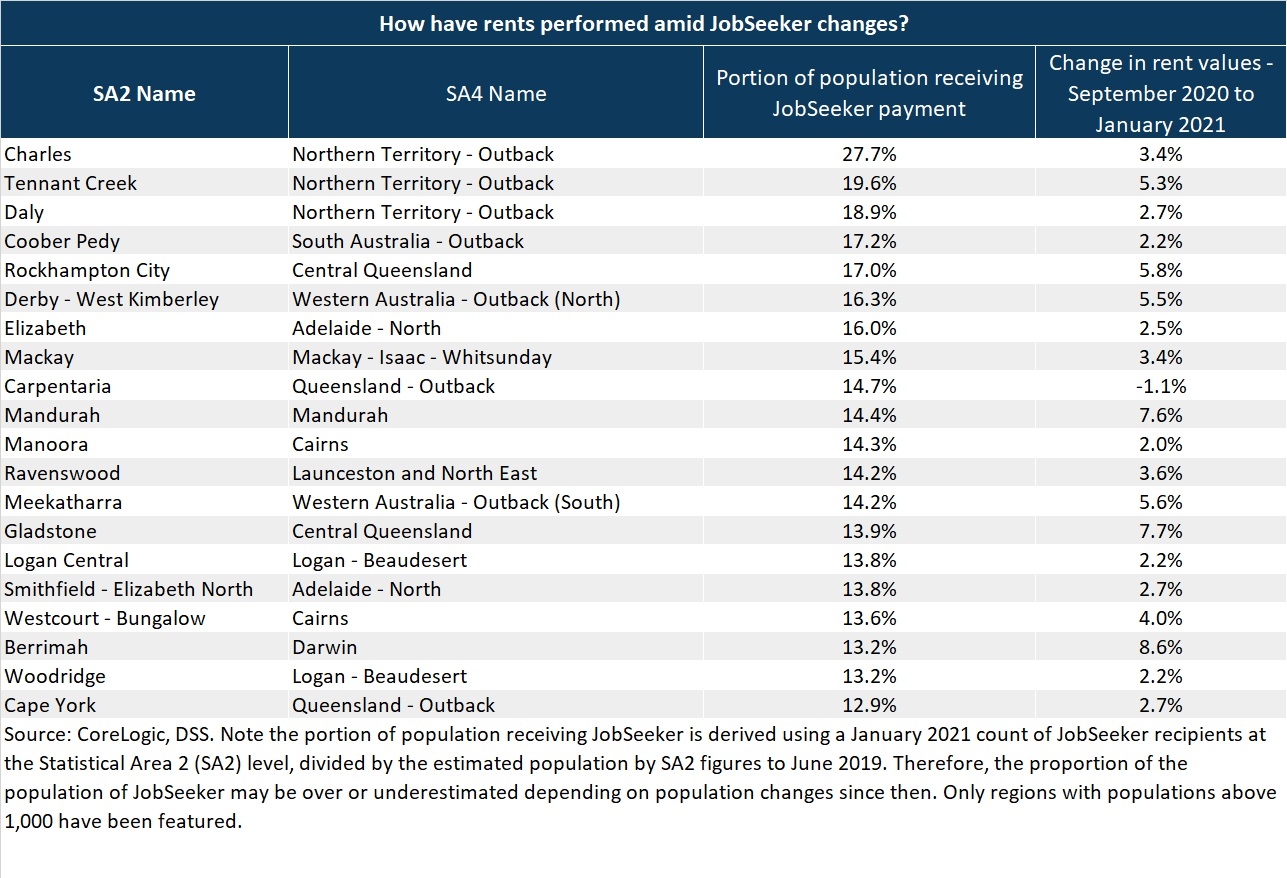

However, even looking at regions with the highest proportion of JobSeeker recipients in Australia relative to the local population, rental outcomes have been mixed since the significant reduction of the Jobseeker supplement in September.

This is demonstrated in the table below, which looks at changes in rents since September 2020 through to January 2021 at the SA2 level, in the markets with the highest proportion of JobSeeker recipients.

Only one region in this list has actually seen a decline in rental values, while other SA2 markets have seen an average increase in market rents of 4.2%, which is actually above the 2.5% increase in rent values nationally over the same period.

Importantly, there is no counter-factual for rental performance in these markets where the coronavirus supplement is unchanged. Under these circumstances, rents may have increased even further.

However, what this data does highlight is that the impending changes to JobSeeker could create increased divergence between incomes and housing costs for some of Australia’s most vulnerable households. While these rental markets may be increasing in aggregate, housing stress, and even homelessness, may be faced by individuals whose livelihoods have been impacted by COVID-19. While changes to JobSeeker are unlikely to impact the housing market, the welfare reduction could greatly disrupt housing situations for many.

Share This Article

Previous Articles

- November 2024 1

- October 2024 1

- August 2024 1

- July 2024 1

- June 2024 1

- May 2024 3

- April 2024 2

- March 2024 1

- February 2024 1

- November 2023 1

- October 2023 1

- September 2023 1

- August 2023 1

- July 2023 1

- June 2023 1

- May 2023 2

- April 2023 1

- March 2023 1

- February 2023 1

- January 2023 1

- December 2022 1

- November 2022 3

- October 2022 1

- September 2022 2

- August 2022 1

- July 2022 4

- June 2022 3

- May 2022 2

- April 2022 1

- March 2022 1

- February 2022 1

- January 2022 1

- October 2021 1

- September 2021 4

- August 2021 1

- July 2021 2

- May 2021 1

- April 2021 2

- March 2021 2

- February 2021 1

- January 2021 2

- December 2020 2

- November 2020 2

- October 2020 2

- August 2020 1

- May 2020 2

- April 2020 2

- November 2019 1

- October 2019 1

- August 2019 1

- July 2019 1

- June 2019 1

- May 2019 1

- February 2019 1

- January 2019 1

- October 2018 1

- September 2018 1

- July 2018 2

- June 2018 2

- May 2018 1

- April 2018 2

- March 2018 3

- January 2018 1

- December 2017 3

- November 2017 1

- October 2017 1

- August 2017 1

- July 2017 1

- June 2017 5

- May 2017 31

- April 2017 30

- March 2017 32

- February 2017 28

- January 2017 31

- December 2016 31

- November 2016 29

- October 2016 30

- September 2016 30

- August 2016 26