Sydney has risen from sixth to third place on a list of 10 global cities ranked on having the highest growth in luxury residential rents over the past 12 months.

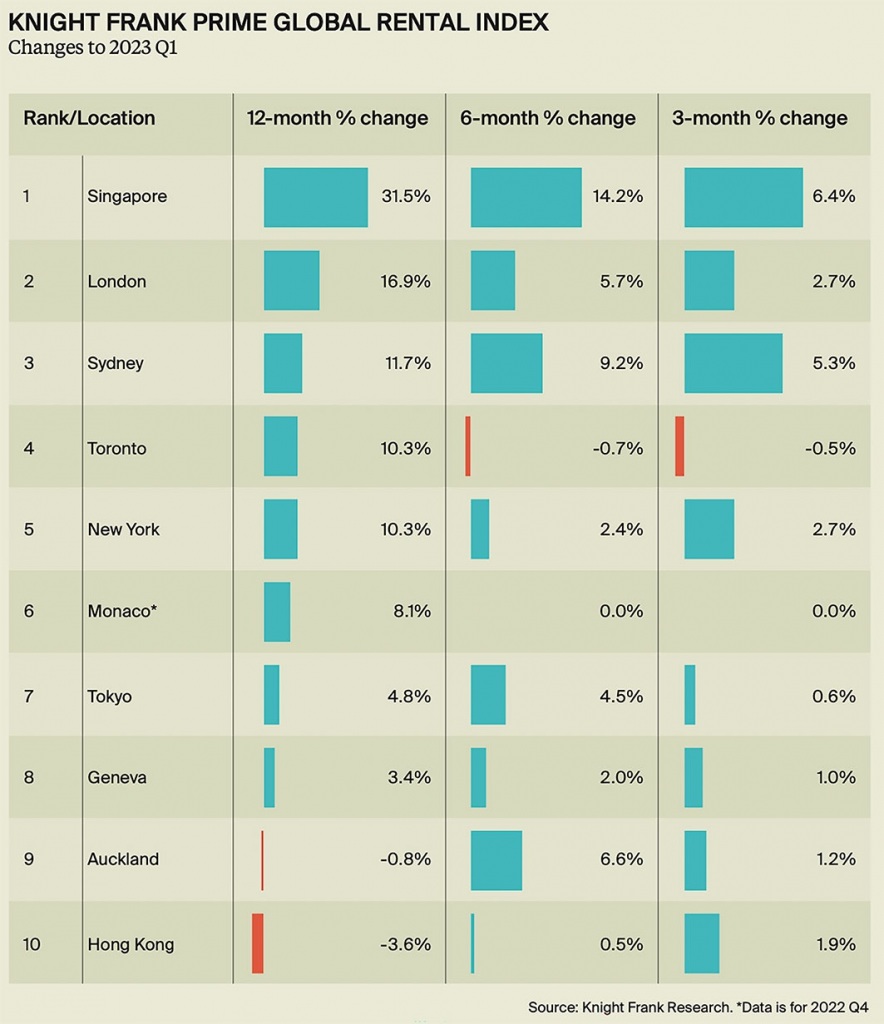

Knight Frank’s Prime Global Rental Index (PGRI) Q1 2023, which tracks the movement in luxury residential rents across 10 global cities worldwide, found Sydney rents for prime property rose by 11.7% over the 12 months until the end of Q1 2023 and 5.3 per cent over the first quarter of this year.

This compares to growth of 3.7% in Sydney luxury residential rents over the last quarter of 2022 and 6.7% over the 2022 calendar year, which saw Sydney ranked the sixth highest behind Singapore, New York, London, Toronto and Tokyo.

Now Sydney is sitting in third place for annual growth, behind Singapore (31.5%) and London (16.9%).

Sydney had the second highest quarterly growth for Q1 2023 (up from fourth place in Q4 2022) and second highest six-month growth behind Singapore, recording a 5.3% and 9.2% rise respectively.

The PGRI increased 8.5 per cent in the 12 months to March 2023 across the 10 cities tracked, with rents in eight out of 10 markets hitting new records.

Globally prime rents are now 14% above their pre-pandemic high (Q3 2019) and 21.7% above the pandemic low (Q1 2021). By comparison, in Sydney, prime rents are 15% higher than their pre-pandemic high (Q4 2018) and 21% more than the pandemic low (Q2 2021).

Knight Frank Head of Residential Research Michelle Ciesielski said rents in global luxury residential markets were continuing to see strong growth.

“While the rate of annual growth in over the first quarter of this year slipped back from the 10.2 per cent recorded in the previous quarter, globally rents are still rising at a rapid clip,” she said.

“This is continuing the trend that started in 2021 as cities recovered from the pandemic and we saw a surge in both global and domestic prime rental demand as workers moved back to cities as economies reopened.

“Sydney’s prime residential rent growth is a somewhat consistent trend alongside the mainstream renal market, which recorded 15.3 per cent annual growth and 3.2 per cent in the first quarter of this year. “

Knight Frank Head of Residential Erin van Tuil said the growth in rents across all residential property in Sydney was being driven by not only strong demand, but a chronic undersupply.

“We are seeing this imbalance between demand and supply in both affordable and luxury residential market, with very low vacancy rates, hence why Sydney prime residential rents have experienced strong growth over the past 12 months,” she said.

“Total residential rental vacancy was 1.3 per cent at the end of March across Greater Sydney according to REINSW.

“The major factors driving the strong growth in prime rents in Sydney are returning expats needing accommodation, as well as a rise in corporate rentals for new talent hires from outside Sydney.

“Construction delays due to labour and materials shortages are also contributing, as tenants are forced to rent for longer while their new builds or renovations are being completed.

“We are also seeing a rise in film production crews looking to secure prime rental properties for extended periods, with short-stay nightly hotel rates having become increasingly more expensive and accommodation is harder to find as business travel ramps up.”

“With housing construction volumes remaining low amid issues faced by the construction sector and fewer developers building product suitable for investors due to a focus on owner occupiers, rents in Sydney’s prime residential market are expected to continue to rise well above trend through 2023.”

Share This Article

Previous Articles

- April 2024 2

- March 2024 1

- February 2024 1

- November 2023 1

- October 2023 1

- September 2023 1

- August 2023 1

- July 2023 1

- June 2023 1

- May 2023 2

- April 2023 1

- March 2023 1

- February 2023 1

- January 2023 1

- December 2022 1

- November 2022 3

- October 2022 1

- September 2022 2

- August 2022 1

- July 2022 4

- June 2022 3

- May 2022 2

- April 2022 1

- March 2022 1

- February 2022 1

- January 2022 1

- October 2021 1

- September 2021 4

- August 2021 1

- July 2021 2

- May 2021 1

- April 2021 2

- March 2021 2

- February 2021 1

- January 2021 2

- December 2020 2

- November 2020 2

- October 2020 2

- August 2020 1

- May 2020 2

- April 2020 2

- November 2019 1

- October 2019 1

- August 2019 1

- July 2019 1

- June 2019 1

- May 2019 1

- February 2019 1

- January 2019 1

- October 2018 1

- September 2018 1

- July 2018 2

- June 2018 2

- May 2018 1

- April 2018 2

- March 2018 3

- January 2018 1

- December 2017 3

- November 2017 1

- October 2017 1

- August 2017 1

- July 2017 1

- June 2017 5

- May 2017 31

- April 2017 30

- March 2017 32

- February 2017 28

- January 2017 31

- December 2016 31

- November 2016 29

- October 2016 30

- September 2016 30

- August 2016 26